- News

- Reviews

- Bikes

- Components

- Bar tape & grips

- Bottom brackets

- Brake & gear cables

- Brake & STI levers

- Brake pads & spares

- Brakes

- Cassettes & freewheels

- Chains

- Chainsets & chainrings

- Derailleurs - front

- Derailleurs - rear

- Forks

- Gear levers & shifters

- Groupsets

- Handlebars & extensions

- Headsets

- Hubs

- Inner tubes

- Pedals

- Quick releases & skewers

- Saddles

- Seatposts

- Stems

- Wheels

- Tyres

- Tubeless valves

- Accessories

- Accessories - misc

- Computer mounts

- Bags

- Bar ends

- Bike bags & cases

- Bottle cages

- Bottles

- Cameras

- Car racks

- Child seats

- Computers

- Glasses

- GPS units

- Helmets

- Lights - front

- Lights - rear

- Lights - sets

- Locks

- Mirrors

- Mudguards

- Racks

- Pumps & CO2 inflators

- Puncture kits

- Reflectives

- Smart watches

- Stands and racks

- Trailers

- Clothing

- Health, fitness and nutrition

- Tools and workshop

- Miscellaneous

- Buyers Guides

- Features

- Forum

- Recommends

- Podcast

news

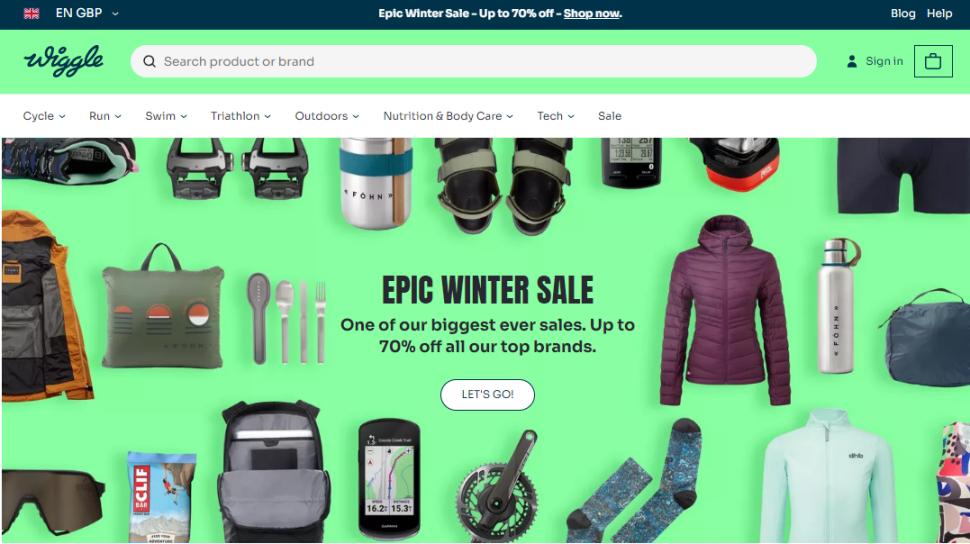

Wiggle Epic Winter Sale

Wiggle Epic Winter SaleWiggle administrator reveals beleaguered cycling retailer made £10.4m profit during administration

Wiggle generated more than £41.7m in sales since the cycling retail giant entered administration last October, the administrator revealing that this resulted in a profit of £10.4 million.

The details come in documents shared by administrators from FRP Advisory Trading Limited, the report covering the year since Wiggle Chain Reaction entered administration in October 2023.

It confirms that 400 of the 447 staff Wiggle had when it entered administration were made redundant, with others opting to resign; while 121 of 137 staff were made redundant at Chain Reaction Cycles and Chain Reaction Cycles Retail.

As per the trading accounts, Wiggle's heavy discounting, clearance sales and bulk stock sales post-cessation of trading led to total sales of £41.7m between 24 October 2023 and 23 October 2024. When costs — including £15.8m of stock purchases — were factored in, it left Wiggle having made £10.4m profit during the period of its administration, a figure the administrators say they are "pleased" with.

Despite this, it is noted that the final trading account will not be available until April 2025 as the final associated costs of trading and final outcome remain fluid. It is also worth noting these figures offer no indication of how the relaunched Wiggle website has fared since intellectual rights were purchased by Mike Ashley's Frasers Group and only refer to trading under the administrators' control.

The administrators detailed that sale process, Ashley's Frasers Group swooping to purchase Wiggle Chain Reaction Cycles' brand and intellectual property at the beginning of 2024. It was initially reported the deal was worth less than £10m, the exact figure turning out to be £3m.

Initially the administrators had looked to sell Wiggle Chain Reaction as a going concern, an offer from an interested party accepted from "a private equity fund with global operations". Despite a completion date set for 19 December and "considerable due diligence and time invested", the proposed buyer withdrew the offer on the day completion was due.

The administrators reported that trading remained profitable but the historically slow start to the year in January and February saw things slow down. In the background, three interested parties continued due diligence with a view to purchasing the business as a going concern. The parties were described as being "Global Private Equity houses and industry competitors".

Ultimately a going concern sale "was not achievable due to the inability to right size the company's operating fixed overheads", particularly the extensive IT infrastructure which had been built "on the assumption that the company would achieve sustainable annual revenues in excess of £1bn".

"In reality the company did not achieve these revenue levels even during peak sales through Covid 19 trading," the administrators said. "The inflexibility of the IT infrastructure ultimately caused the parties considering a going concern purchase to all fall away."

On 22 February, Frasers Group bought the intellectual property for £3m plus VAT, an initial payment of £2.625m paid on completion, the rest to follow once all necessary transfers of intellectual property concluded, something which has now happened.

It is also noted that administrators negotiated a licence for brands, meaning remaining stock could be shifted via accelerated closing down sales. The successful post-administration trading has generated enough that there is confidence all preferential creditors will be paid in full.

The are no charges registered for secured creditors, while it is estimated that there may be a total of "around £174k" in final preferential creditor claims, such as arrears of pay, unpaid pension contributions and holiday pay.

"A claim for unpaid pre-appointment pension contributions has been processed by the administrators' staff in conjunction with the pension provider [...] and this claim accounts for £108k of the above preferential claim," the report states.

"It is currently anticipated that preferential creditors will be paid in full subject to the final asset realisations and settlement of professional fees."

Final claims for secondary preferential creditors are awaited from HMRC but are estimated to total around £2.78m. HMRC ranks these in respect of: VAT, PAYE (including student loan repayments), Construction Industry Scheme deductions and employees' NI contributions. It is also estimated that these will be paid in full.

The administrators also believe that "there should be sufficient funds available" to pay a dividend to unsecured creditors "in due course, subject to the final costs of the administration and subsequent liquidation".

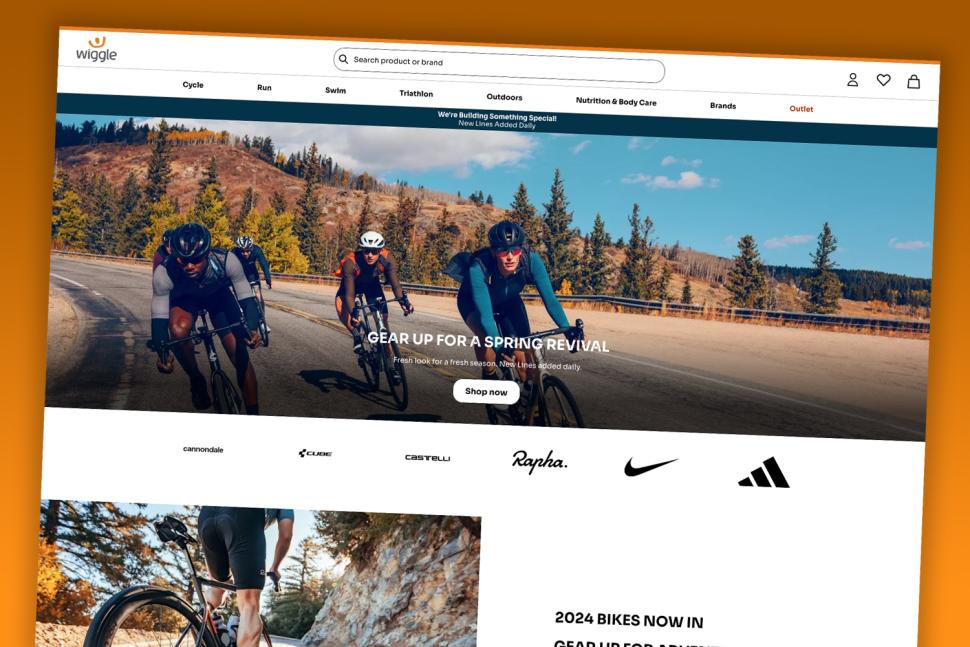

Since the intellectual rights were bought by Ashley's Frasers Group, who added the business to its retail empire that already includes Evans Cycles, the website has been relaunched with its old orange logo.

In May, a massive clearance sale on Wiggle Chain Reaction outlet products began at Evans Cycles, with cyclists spotting discounts of up to 70 per cent on the ill-fated brand's stock.

According to images from the Cheetham Hill, Manchester branch of Evans Cycles, Kask Protone road helmets which retail for around £200 were being sold for £40, while some e-bikes were priced at £250. The sale also included Castelli and DhB clothing, and boxes including smaller items and accessories such as pumps and lights could also be seen in the photos, prices starting at just £1.

No financial reports or figures have been offered for the new Frasers Group Wiggle since its purchase in February, although Evans Cycles' latest accounts for the financial year ending April 2023 saw a £22.8m post-tax loss, significantly worse than the £5.3m loss posted a year earlier.

Dan is the road.cc news editor and joined in 2020 having previously written about nearly every other sport under the sun for the Express, and the weird and wonderful world of non-league football for The Non-League Paper. Dan has been at road.cc for four years and mainly writes news and tech articles as well as the occasional feature. He has hopefully kept you entertained on the live blog too.

Never fast enough to take things on the bike too seriously, when he's not working you'll find him exploring the south of England by two wheels at a leisurely weekend pace, or enjoying his favourite Scottish roads when visiting family. Sometimes he'll even load up the bags and ride up the whole way, he's a bit strange like that.

Latest Comments

- mdavidford 1 sec ago

Eh? One rider in primary is going to require much the same amount of room to pass them as two riding abreast.

- BikingBud 47 min 12 sec ago

And horses/horse riders.

- David9694 1 hour 30 min ago

Motorist Mike demands 40p back after overcharged on new £11m 'prison' car park...

- BikingBud 9 hours 5 min ago

Was there?...

- ChrisA 10 hours 50 min ago

Balance bike: £600 - brakes extra.

- PRSboy 14 hours 35 min ago

I have two aero bikes- an Argon18 Nitrogen and an Orro Venturi. I love the way they feel on the road. I also like the style of the deeper section...

- Rendel Harris 22 hours 12 min ago

They have here: results at 14.40. The aero bike was roughly fifteen seconds faster than a climbing bike on a descent of around 6 km, so about 3km/h...

- wtjs 22 hours 26 min ago

As I've also placed here the nutter Audi and white van drivers, I've decided to give those no-nonsense keep-the-country-moving BMW drivers a list...

- polainm 23 hours 29 min ago

100% this. Policing mentality is formed by social 'norms', and the cyclist witchhunting across social media is the UK norm. Close passing a person...

- David9694 1 day 54 min ago

That's a clear 2 points awarded there, but I guess as there's now a 25% tariff you'll only get 1.5

Add new comment

17 comments

These IT workers are breeding like rabbits

Copying is an elementary operation...

Resistance is futile! You will be assimilated!

Also work in IT.

Nobody works in IT anymore. We all work for the IT.

Speak for yourself

Work in IT.

Cannot for the life of me figure out what could possibly be so inflexible about IT infrastructure.

Also work in IT.

I am betting someone saw they could get a rebate on buying a huuuge infrastructure based on projected sales from a trigger happy sales department by locking down the size of the infrastructure for years to come. Then the sales did not materialize and someone had to pay the stupid tax.

Happens all to often.

They were running Oracle, probably couldn't get out of the contract.

Also work in IT.

They were before change all systems, then went downhill due to bad adminstration aka CEO who agree to proceed with the worst system I have seen plus not ready or adapted to a online business.

We all knew from the start of rumours that Mike would buy everything cheap and kick all the knowledge staff. We all have been treated like shit bike CEO and Administration who keep fobbing staff with BS promises while everyone was working hard to get their wages paid with short staff and constantly under pressure.

Unfortunately, I work with (despite) Oracle databases and I am of the opinion that no-one should ever choose Oracle as a business partner. They're the "abusive partner" of the IT world with their litigation-heavy threats against companies they think they can squeeze more money out of.

(Their database product is actually good, but the big danger is when you customise software to rely on Oracle features and then can't easily move to something like Postgres)

This.

It's not just the database that they're famous for, but also technologies like Java, and the open source database MySQL. They aggressively enforce their licensing on non-obvious aspects can catch people out as a result.

I'd have used both technologies mentioned previously, but have moved away from them completely now as I don't want to deal with or think about that.

In the Wiggle/CRC case I'd imagine the comment about them being locked into a long term contract if a going concern could be on the mark.

Technical debt - there's a whole bunch of different things thrown together to run the business (think random Excel spreadsheets; some old Visual Basic routine that the CEO's grandson put together; sales teams reliant on a janky Access database that wither pulls or pushes data into their Oracle products), and no-one has enough knowledge or time to upgrade/migrate them to something more sensible and the top-level managers don't want any changes as they're reliant on how the system works and any changes will undoubtedly cause disruption to their department.

Having been through redundancy due to an employer going bankrupt, it's good to read that the employees should get their redundancy and pension contributions. Should be noted that probably includes employee contributions deducted at source.

Is the headline not misleading. when the stock was purchased at 3 million in the fire sale with estimated 80 million at retail and blown out for 10p in the £, Ashley does what he does best in cleaning the carcass . Now that most of the remaining saleable stock has gone and he has made his investment back it will fade and die. Shame that nukeproof and dhb were not SAVED

Where does it state in the article that Ashley purchased the stock? it does state that Ashley bought the brand and intellectual property, not the stock, which the administrators sold.

Stock has/is being sold through Ashley's outlets though. As per the article "In May, a massive clearance sale on Wiggle Chain Reaction outlet products began at Evans Cycles". A friend also metioned to me he recently picked up a pair of tribars from one of the CRC "own brand" (Prime?) in Sports Direct

I wonder if the company who did the website redesign got paid before Wiggle went into administration?

They don't deserve any payment, but the rebrand was done before Ashley got his stinky hands on it, so they probably did.