- News

- Reviews

- Bikes

- Accessories

- Accessories - misc

- Computer mounts

- Bags

- Bar ends

- Bike bags & cases

- Bottle cages

- Bottles

- Cameras

- Car racks

- Child seats

- Computers

- Glasses

- GPS units

- Helmets

- Lights - front

- Lights - rear

- Lights - sets

- Locks

- Mirrors

- Mudguards

- Racks

- Pumps & CO2 inflators

- Puncture kits

- Reflectives

- Smart watches

- Stands and racks

- Trailers

- Clothing

- Components

- Bar tape & grips

- Bottom brackets

- Brake & gear cables

- Brake & STI levers

- Brake pads & spares

- Brakes

- Cassettes & freewheels

- Chains

- Chainsets & chainrings

- Derailleurs - front

- Derailleurs - rear

- Forks

- Gear levers & shifters

- Groupsets

- Handlebars & extensions

- Headsets

- Hubs

- Inner tubes

- Pedals

- Quick releases & skewers

- Saddles

- Seatposts

- Stems

- Wheels

- Tyres

- Health, fitness and nutrition

- Tools and workshop

- Miscellaneous

- Tubeless valves

- Buyers Guides

- Features

- Forum

- Recommends

- Podcast

news

Halfords barrier logo 3x2 (copyright Simon MacMichael)

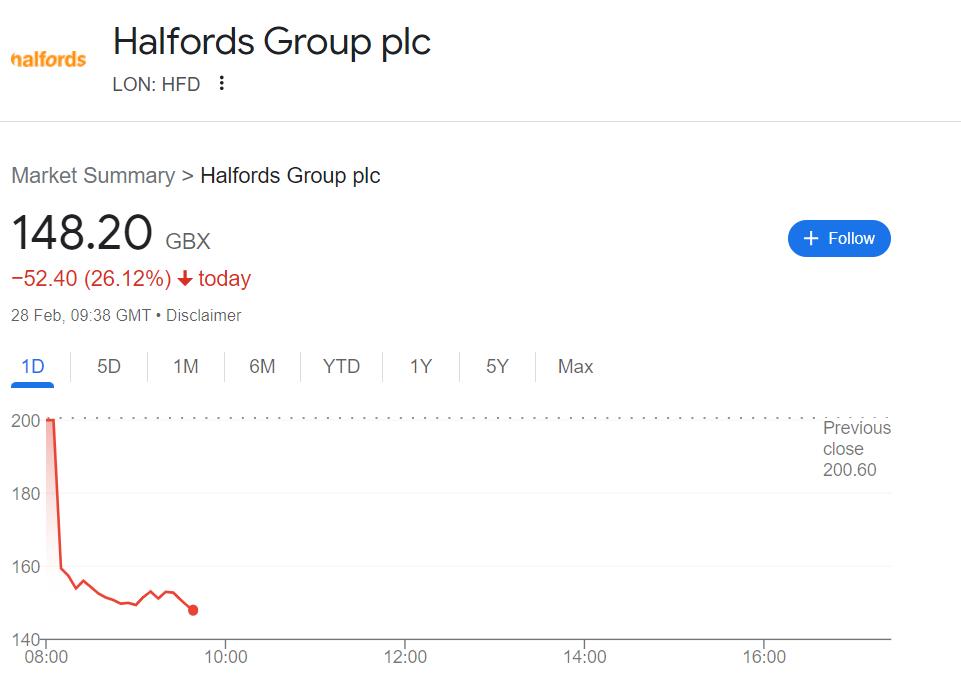

Halfords barrier logo 3x2 (copyright Simon MacMichael)Halfords share price plunges 25% as retailer downgrades profit forecast amid continued weak cycling demand

The share price of the UK's largest retailer of cycling products and services, Halfords, has plummeted following an announcement from the business that amid a slow start to the calendar year its profit forecast has been downgraded by at least 17 per cent.

Halfords' share price has fallen as low as 140 pence this morning, more than 25 per cent down on its closing price of 200 pence, and hitting its lowest level since October 2022. The market reacted to Halfords revealing that its January sales had disappointed, with cycling-related sales eight per cent lower than in the same month last year. Elsewhere, motoring sales were down five per cent, while tyre sales were down four per cent.

In its latest quarterly accounts, released last month, the company reported its bike market had performed "significantly worse than anticipated", a trend that appears to have continued into 2024.

Now, Halfords has blamed poor weather for hitting its business, rain and warmer temperatures meaning lower footfall in its shops and reduced sales of anti-freeze.

Consequently, for the current financial year, to March 29, Halfords has downgraded its pre-tax profit forecast to £35-40 million, down from at least 17 per cent from the £48-53 million figure given last month. Looking to the future, Halfords predicted that the 2025 financial year would be broadly similar to 2024, suggesting the bike industry's recovery following a few challenging years may have some way to go yet.

"While our macro indicators for disposable income growth this year are all lit up green, which bodes well for spending power into the second half of 2024, consumers still remain cautious, shopping by need," Peel Hunt analysts told Reuters of the situation at Halfords, noting that taking market share is a positive, but customers continue to count costs and shop "by need" given the economic picture.

Halfords' share price boomed during the pandemic, rising from 66 pence in March 2020 to a high point of 434 pence in July of the following year. It experienced a steady fall in the 12 months following that peak, before staying fairly consistent in the 18 months preceding today's drop.

Last year, amid poor cycling performance, the business said it would focus on "needs-based" sources of revenue, such as cheap motoring repairs, in a bid to fill the gap left by "discretionary" spending areas, such as cycling and car cleaning, which were "adversely affected by unfavourable weather and low consumer confidence".

The noises last June were, however, that in the long term Halfords remains "very, very confident" about the cycling market. "Cycling still hits the sweet spot in terms of climate change… We still think it's the right place to be," the retailer's chief executive Graham Stapleton said at the time.

Those comments came a year after, in June 2022, the company warned of a "considerable softening of the cycling market" following its pandemic boom, with supply chain disruption and inflation beginning to bite.

Dan is the road.cc news editor and joined in 2020 having previously written about nearly every other sport under the sun for the Express, and the weird and wonderful world of non-league football for The Non-League Paper. Dan has been at road.cc for four years and mainly writes news and tech articles as well as the occasional feature. He has hopefully kept you entertained on the live blog too.

Never fast enough to take things on the bike too seriously, when he's not working you'll find him exploring the south of England by two wheels at a leisurely weekend pace, or enjoying his favourite Scottish roads when visiting family. Sometimes he'll even load up the bags and ride up the whole way, he's a bit strange like that.

Latest Comments

- jnthnwd 7 min 31 sec ago

As a heavier rider, my latest wheelset was assembled in the UK using Light Bicycle deep carbon rims (with Hope hubs, Sapim spokes). Components as...

- Secret_squirrel 18 min 2 sec ago

I think you are confusing intentionality with negligent behaviour....

- panda 33 min 57 sec ago

My memory fails me, but I recall one of the aero engineers back in the day (most likely Josh Poertner at Zipp (then) or Gerard Vroomen or someone)...

- Rendel Harris 2 hours 10 min ago

I remember that, "I can't wait to see an Australian walking into a shop in London and saying, ' Give us a roll of Durex, mate', the sales...

- chrisonabike 2 hours 40 min ago

Surprised - yes. Shocked? Not sure. I'm sure more people would hope it was less......

- hawkinspeter 10 hours 51 min ago

I used an iPump Twist a couple of times and it's not exactly designed for pushing a lot of air but didn't give me any issue apart from taking a...

- hapaxlegomenon 11 hours 43 min ago

these look like they run super Duper narrow!

- hapaxlegomenon 12 hours 4 min ago

I agree on all points. In case you're wondering, this specific model runs a bit narrower than most other fizik SPD shoes that I've worn in the past...

Add new comment

4 comments

The recent 25% plunge in Halfords' share price following their profit forecast downgrade is a stark reminder of the challenges facing the retail sector, especially in the cycling segment. This downturn reflects not just seasonal fluctuations but possibly deeper issues with consumer spending habits and market saturation. This incident underscores the volatility of market demands and the critical need for agile pricing strategies. My journey mirrors this challenge, grappling with maintaining competitive pricing in an ever-shifting market. That's until I discovered Priceva. Priceva revolutionized how I approach pricing. The convenience of automated price monitoring and receiving daily reports meant I could focus more on strategy and less on the manual tracking of competitor prices.

As there are no independent shops here, I have started using Halfords for bike bits.

Truly we have entered the rapid decline of Western civilisation

Is that the period when we have a few extremely high-end luxe retail outlets but then everything else is owned by Mike Ashley?